How to Start a Financial Coaching Business?

Do you have enough finance expertise to guide people towards their financial goals? Well, then you could carve a successful career as a finance coach!

8 out of 10 Americans experience financial stress! Thanks to inflation, recession, and the looming uncertainty in the job market! So, if you could use your knowledge to help people make mindful money choices, starting a financial coaching business could be a fulfilling career!

But it is much easier said than done!

Financial coaching is a hugely regulated industry. Here’s our detailed guide on how to start a financial coaching business:

- Who is a Finance Coach and Qualities for Becoming One

- How to Start a Financial Coaching Business

- Successful Financial Coaches Examples

- How Much Do Finance Coaches Earn

Who is a Finance Coach and Qualities for Becoming One?

A finance coach educates people about financial literacy and helps them improve their finances. Typically, a financial coach guides people to make more money, build savings, reduce debts, create a budget, and achieve financial freedom.

They are different from financial advisors, who specialize in financial investments and wealth-building. A finance coach offers a more holistic approach to attaining long-term financial goals.

At a deeper level, they also work on changing people’s beliefs, attitudes, and behaviors, improving their financial habits and decisions in the long run.

But not everyone can become a financial coach!

Let’s see the essential qualities and skills to be a finance coach!

- Industry-specific knowledge of financial planning, investment, tax planning, etc.,

- Analytic Skills

- Certification or accreditation in a specific finance niche

- Critical thinking and problem-solving skills

- Good communication and listening skills

How to Start a Financial Coaching Business in 5 Easy Steps?

Now that you know the basics of financial coaching and the requirements to become a financial coach, let’s dive into the detailed steps to starting finance coaching!

Step 1: Gain Education and Credentials to Get Started

While each coaching type has benefits and challenges, financial coaching is a different terrain altogether. Here, you are dealing with people’s money—a risky affair altogether!

Hence, first let’s discuss the initial preparation to launch your finance coaching business!

Determining the Right Niche

While you might be a finance guru knowing everything from debts to investments, dealing with everything won’t help!

Having a niche helps you to strategize your coaching business better! From designing your coaching packages to building your brand, everything falls into place!

Do you want to be an investing and financial wellness coach, or do you want to recommend tax-planning coaching services?

Finding your niche is more about navigating the whys and discovering the reasons to become a finance coach.

Here are a few niche ideas to get started:

- Tax-planning coach

- Wealth-building coach

- Money mindset coach

- Business Finance Coach (helping entrepreneurs maximize profits and revenue)

- Investment & Finance Wellness Coach

- People-focused niches specializing in age, occupation, gender, income, etc.

(e.g. finance coaches helping women)

Get Certified

Finance coaching doesn’t necessarily require certification; your experience and knowledge are more crucial. However, having a certification provides the necessary credibility to get started.

Listed below are the some financial coaching certifications:

- Accredited Financial Counselor(AFC)

- Certified Financial Planner (CFP)

- Chartered Financial Analyst (CFA)

- Financial Fitness Coach

- Certified Financial Planner Program

Moreover, if you are starting a new one, getting certified provides the foundation and keeps you updated with the ongoing industry practices. Certifications cover different topics, such as behavioral psychology, pedagogy, regulations, trends, etc.

Step 2: Legalizing Your Coaching Business

Pick a Business Name & Entity

Before you start your business or complete the paperwork, find a business name. Your name should be clear and unique and reflect what you offer.

Your business name is the first business aspect that your clients come across! Hence, choose carefully and let it stand out!

Another essential aspect of your business name is determining your business structure. What kind of business structure aligns with your business goals?

There are four significant types of business entities:

1. Sole Proprietorship

Sole proprietorship is the simplest form of business entity. It is perfect for less complicated, low-risk businesses where income must be shown on a personal tax return.

2. Partnership

As the name suggests, this business type is run by two or more people. So, obviously, the profits and liabilities are shared equally. Comparatively, this structure is risky and not suitable for coaches.

3. Limited Liability Company (LLC)

An LLC is recommended for high-risk businesses with a lot at stake! It is a hybrid business structure that protects the owners’ assets from liability and offers flexible tax options.

4. C-Corporation and S-Corporation

These are advanced business structures perfect for scaling your business.

Licensing and Insurance

While financial advisers need licensing in some scenarios, finance coaches need not be licensed. But licensing elevates your overall image and ensures safety for the clients seeking consulting from you.

Consider the following steps to get licensed as a finance coach:

- Perform research regarding your niche’s licensing requirements.

- Get registered with the appropriate government.

- Adhere to the other relevant regulatory bodies.

Coaching contracts are non-negotiable aspects of a coaching business. It helps to set rules and responsibilities and define boundaries before your coaching process. A typical contract includes liability clauses, refund policy, payment details, and disclaimers.

Another, essential legality while venturing into a risky financial coaching terrain is insurance. After all, getting sued by a client is the last thing you would expect for your coaching business!

Step 3: Processes to Launch Your Coaching Businesses

Now, you are done with setting the foundation for your coaching business! It’s time to create the pillars for your business. The first pillar to build the structure is to set up the processes!

But before moving onto processes, carving your unique proposition through a personal brand is essential!

Creating Your Brand

Trust and credibility are two core aspects of our practice as finance coaches. A personal brand is a great way to communicate your value and win clients for your coaching business.

Here are the essential branding elements:

- Establishing a Unique Value Proposition

How will you stand apart from the sea of finance coaches? That’s why a unique business proposition matters! Your USP could be your experience, like successfully enduring a financial crisis, a super-specific niche, or a different approach to financial planning.

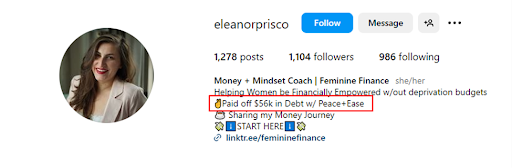

Eleanor Prisco includes her financial struggle of paying $56K debt as USP in her social bio.

- Creating a Memorable Tagline and Logo

A befitting logo and captivating tagline are the obvious elements of branding! Your logo could be based on your business name, initials, mission, values, and financial coaching services.

Similarly, your tagline conveys the benefits or results of your coaching services.

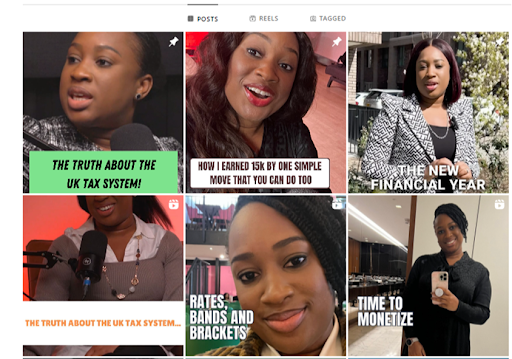

Benedicta’s tagline clearly captures her mastery with money management and tax planning.

- Building a Consistent & Professional Brand Image

Brand-building is essentially about presenting a consistent brand image. First and foremost, you need to build a professional website that highlights your signature offerings, testimonials and past achievements.

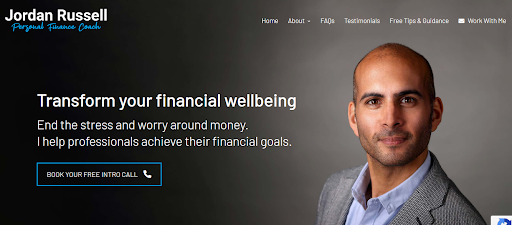

Personal Finance Coach Jordan Russell sells his coaching calls through his professional website.

- Leveraging the Power of Social Media

Share your expertise, valuable insights, tips, and videos through your social media handles.

Benedicta Egbeme shares interesting insights, experiences, and financial tips on her Instagram page.

Outline a Coaching Plan

Now, let’s move on to the most essential part of your coaching process — creating your signature offer!

1. Determine Your Target Audience

You are designing your package for your clients. So, the first step is to research your target audience and understand their needs and expectations.

Ask the following questions:

- Who is your ideal client?

- What are the chief struggles your client is experiencing?

- Brainstorm the causes of the problem.

- Determine the skills for overcoming the problem.

- What are their preferences and interests?

The best sources for gathering information are interviews, social media, online surveys, etc.

2. Design Coaching Package

Now, let’s move on to crafting your first coaching package.

Here are the essential aspects of designing a coaching program:

- Coaching Package Name

- Coaching Outcome

- Benefits & Objectives

- Program Timeline

- Session Duration

- Delivery Methods (e.g., 1-1 coaching calls, workshops, online courses)

For instance, you might need frequent sessions in the initial months of your coaching program. Later as your coaching picks up pace, your clients just need 20-min check-in calls or fewer coaching sessions.

3. Create Coaching Materials & Session Plans

Once you have the basic framework of your coaching program, it’s time to create the session plan.

Your session outline typically depends on your outcome.

Here’s a basic session plan for the financial coaching program:

| Initial Assessment | Gather information about current financial situations including income, debts, cost of living expenses, daily spendings,etc. |

| Goal-Setting | Set goals & milestones to achieve your outcome. E.g., Spending less on non-essential items, reduce living expenses, etc., |

| Developing Financial Plan | Analyze your income & savings potential and create a personalized financial plan to reach your goals. |

| Monitoring & Evaluating Progress | Review the financial strategies implemented — how far the client is adhering to the plan and the results. |

A one-size-fits-all approach doesn’t work for coaching! Although the end goal might be the same, the budgeting plan that worked for one client might not work for another.

Leverage coaching methodologies like the GROW and the OSKAR model based on your clients. Integrate techniques like the Financial Wheel of Life, exercises and worksheets into your coaching sessions.

Decide the Package Price

Determine your package pricing based on the hourly rate for each session and the value you offer. Then, deduce the monthly rate from it. For a 6-month coaching program, $2,500 is an ideal price. This includes the weekly, bi-weekly, and monthly sessions.

Hourly rates, flat fees, and monthly retainer or performance-based are the three pricing models. Additionally consider costs for preparing the materials for session plans, reviewing the questionnaires, and emails between the calls.

Your coaching package isn’t a final product; get feedback, tweak, and refine your offerings!

Step 4: Systems to Deliver Coaching Sessions

The next pillar is choosing the right systems for delivering your coaching sessions! After learning the ropes of trade, let’s explore the tools of trade!

Identify Coaching Tools

Let’s take a look at all the tools you need through the coaching journey!

| Technology | Software |

| Video Conferencing Tools | Zoom, Google Meet |

| Email Marketing | Mail Chimp, ConvertKit, |

| Appointment Scheduling | Calendly, Acuity Scheduling |

| Budgeting & Financial Planning Software | Mint, You Need a Budget, Tiller Money |

| Payment Integration Tools | Stripe, PayPal |

| Bookkeeping | Bench.co |

| Design Tools | Canva, Vimeo |

Step 5: Resources to Grow and Evolve Your Business

While you have laid the foundation and established the pillars of your coaching business, the next step is to scale your business!

You need a strategic plan and decision-making skills to take your business to the next level.

Market Your Coaching Business

Don’t limit yourself to your first initial set of clients; spread the word!

Leverage the following marketing strategies to reach your target audience:

- Create valuable content and share your experiences and insights through blogs on your website.

- Share client results and testimonials on your website or social media stories.

- Optimize your professional website for trending keywords, meta titles, site speed, etc.

- Post exclusive content on trending topics, tips, and solutions to relevant client problems.

- Invest in PPC or social media ads to gain more visibility.

- Offer freebies or opt-ins to your existing and potential clients.

- Network through industry events, collaborations, and webinars and build your client list.

- Build an email list for sharing newsletters and interesting niche-related content.

- Ask for client referrals and leverage word-of-mouth marketing

Diversify Your Revenue Streams

You might have achieved your initial milestones and revenue goals with 1:1 coaching calls.

But what next?

Don’t limit your business to a fixed finance coaching service or a revenue goal!

Diversify and explore other revenue streams, such as online courses, group coaching, workshops, and selling webinars. For example, if your signature debt management program generates significant revenue, package it as an online course.

With group coaching, it helps you earn quick bucks without increasing your working hours. Yes, you can’t neglect YouTube’s attractive lead magnet! Although, the results start showing up slowly, but there are several coaches monetizing from the same!

After building a good portfolio, you could also try your hands-on brand partnerships or in-person speaking engagements.

Create a Community

Once you have established enough niche authority, you can step up and create an amazing community centered around your coaching business.

The best way to do that is setting up a community marketplace! Pinlearn is a robust ready-made script to create a marketplace easily without any coding knowledge! It is a highly customizable white-label script with video conferencing tools, appointment management, course management and analytics features all under the same roof!

So, finally, we are done with the coaching business steps! Navigating through the financial landscape could be challenging, and some inspiration would certainly be helpful!

Successful Financial Coaches to Drive Inspiration

This section explores exceptional success stories of finance gurus who have mastered their business!

Ellie Austin Williams (@thisgirltalksmoney)

Ellie Austin Williams, a certified finance coach, financial well-being speaker, and author of the book Money Talks, is truly a multi-hyphenate juggling multiple hats at once. This girl talks money is her professional financial platform, offering services like online or offline workshops, speaking events, brand partnerships, etc.

She is a well-known columnist on Stylist, The Sunday Times Refinery29, and Cosmopolitan and works with brands like Scottish Widows, Sainsbury’s, and American Express.

Williams educates people about money and how to make better and well-informed financial decisions. With an amazing online community of 45,000 people, you can find her sharing content from the gender pay gap to emergency funds.

Laura Ann Moore

A certified financial coach and personal finance educator, Laura Ann Moore demonstrates her expertise in money mindset coaching. Moore has an active community of over 52K followers on Instagram, TikTok, YouTube and her exclusive podcast.

With a strong portfolio of working with brands like Zopa, Amazon and Amex, she has been nominated for several prestigious awards.

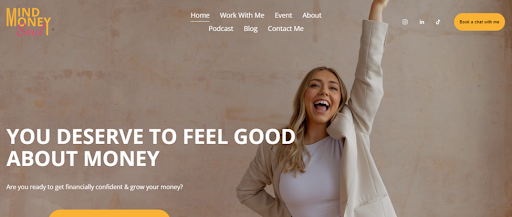

Her unique selling proposition is to help people feel good about money, build wealth and attain financial freedom in a jargon-free way. MindMoneySoul is her financial education platform that hosts 1:1 coaching calls, events, podcast channel, and finance blogs.

How Much Do Financial Coaches Earn?

Whether you’re pursuing coaching as a side hustle or a full-time career, financial coaching is a lucrative business!

The average salary of a finance coach is $47,895 yearly. Thus, the hourly rate comes around $20-$22.

According to Salary.com, the average finance coach’s salary is $74,666 per year. If that’s too high, then there are several financial business coaching planners who make around $200,000 to $400,000 per year.

Earnings depend on factors like education, certification, location, and experience. Although initially, much of your time and budget will be spent setting up your coaching business, you can churn in the profits later.

As a finance coach, you can earn hourly, monthly(retainer) or on a package basis (recommended).

Ready to Start Your Financial Coaching Business Today?

With all those strategies and figures, now you know that financial coaching is a profitable endeavor! It’s not just the knack for numbers, expenditures, and wealth-building practices. You also need a clear vision of the processes and familiarity with the tools and legal frameworks to build your financial coaching business!

Most importantly, every customer journey is unique! Scripting their customer journey requires a carefully crafted coaching offer to the best of your experience!

FAQ-Related to How to Start a Financial Coaching Business

1. Is there a demand for finance coaches?

Yes, there is a significant need for financial coaching, considering the financial stress endured by people worldwide. People are not only seeking financial advice for managing debts and organizing their finances, but also to achieve their long term goals.

2. Do financial coaches make money?

Finance coaches make around $100 to $300 per hour and approximately $74,470 yearly.

3. How do you get financial coaching clients?

As finance coaches, you can find clients through email marketing, blogs, social media marketing, referrals, free consultations, and other marketing strategies.