Top 8 Tips for Early-Stage EdTech Startups: A Deep Dive into the Investor’s Mind

Have a million-dollar product idea and looking for the right investors? Well, then finding the right investors requires strategy and research. From VCs to angel investors, there are diverse investor types to choose from.

Some provide capital, some guidance, and some like VCs are a complete package offering both. But, is there a golden formula to appease them? A compelling pitch deck isn’t enough to secure the right financial backing.

This blog explores all the key aspects that investors look for in early-stage startups. So, let’s find out what you need to raise your next funding?

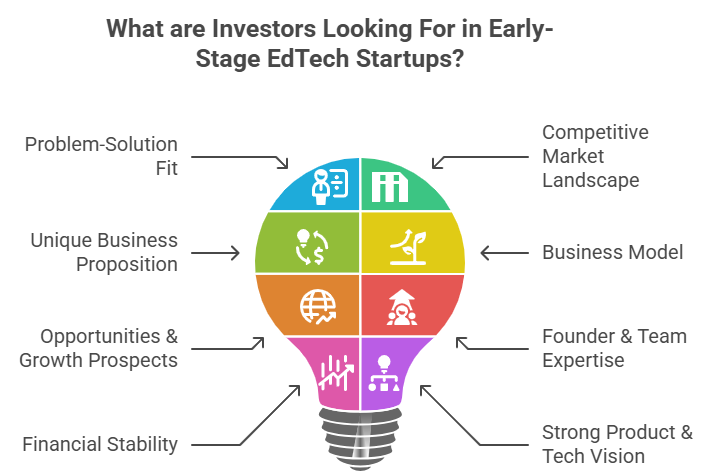

What are Investors Looking For in Early-Stage EdTech Startups?

Now, raising an investment is more challenging than ever! An excellent business idea won’t be enough; investors also look for the right execution.

As Scott Adams quoted, “Ideas are worthless. Execution matters more.”

So, here we have listed the top 8 aspects your edtech business must demonstrate to get a nod from your investors!

1. Problem-Solution Fit

One of the first things investors look for is a product that’s a problem-solution fit.

So, does your product address an actual pain point?

Because if only there exists a real problem, your product can succeed!

For example, Duolingo is a language learning app that makes language learning more engaging. Its bite-sized language lessons are perfect for beginners to get into the learning groove.

While many entrepreneurs are trying to step into the edtech industry, the problems are either too small or already solved. So, the product fails to make it big. And few fail in the initial few years itself!

Investors give a green signal when your product offers:

- Deep product problem in an underserved market

- The product aligns well with educational institutions, learners, educators, etc.

- Solution meets a specific market segment.

2. Competitive Market Landscape

Does your solution have a potentially large market? Is it scalable into the K-12, corporate, higher education, and test preparation market? This shows evident demand for your product and revenue.

Here’s how you can find the market size of your edtech startup:

- Identify the market segment

- Use an appropriate market sizing method: top-down or bottom-up approach

- Gather data and insights from market reports, surveys, landing pages, or interviews

- Adjust your estimates based on trends and barriers

- Evaluate the market gap — existing market supply and unmet demand

The actual market size helps to determine if your market is actually viable. Consider factors such as location, demographics, behaviours, needs and preferences.

Here, you need to assess the total addressable market (TAM), or the revenue you can generate once you capture 100% of the target market.

3. Unique Business Proposition: What’s the Moat?

The edtech industry is competitive, with new players emerging every day. So, how would your edtech product stand the test of time? A unique business proposition is your competitive advantage in this fierce race!

And it’s one of the essential things investors notice during funding. Given that, your edtech product should address a particular user pain point.

For example, you’re building a math tutoring app for middle school students. With customized learning paths, you could help learners struggling with the subject.

Moreover, your unique selling point could be your advertising tactic.

Here’s a list of possible unique selling points to get noticed:

- Tailored learning journeys

- Unique content delivery

- Data-driven insights

- Cost-effectiveness

- Deep integration into existing system

While your solution shouldn’t score for all the points, mastering a few aspects is fine.

4. Business Model

The most innovative ideas are obsolete without a solid business model!

A business model includes key activities and resources to attract revenue.

Simply put, your business model is your profit-making plan. Investors aren’t just looking for the numbers your product can churn, the implementation matters.

The business model proves how your edtech vision would look a few years down the road. Perhaps, your future business performance!

From freemium to commission-based, there are several possibilities. You can choose an appropriate model that fits your business needs.

Here some key points investors look in a business plan:

- Revenue potential

- Customer segments

- Distribution and go-to-market strategy

- Unit Economics: Low customer acquisition cost & lifetime value

- Pricing strategy

- High retention

Besides, how your edtech solution can scale across your region is something investors look forward to. Because the way your Edtech business scales in the U.S. is not necessarily how it scales in Asia and European markets.

Another area to consider is your solution’s evident educational impact. Measure whether it can bring in any expected change to the learning outcome or efficiency.

5. Opportunities & Growth Prospects

Is your product a one-off product or scalable? The potential of your product in the next 2 to 3 years ensures you remain in the race.

When investors fund your edtech product, don’t expect growth for just a few initial years. However, ensure substantial growth for every round of financing.

So, you should invest in scalable solutions that are able to expand without compromising the learning experience.

Trends like mobile learning, AI, and learning analytics are unveiling new possibilities. Adopting these innovations is a safe strategy to earn investors’ trust.

The future of the edtech industry is for those who adapt & evolve with these trends. Hence, only by embracing change can you evolve with learners’ needs and preferences.

6. Founder & Team Expertise

Do you have a solid portfolio of successful startups under your belt?

Investors often look into your past success in the industry while approving seed funding. Your experience proves your knowledge & expertise. Moreover, it proves your familiarity with challenges in the edtech industry.

Take the case of Duolingo, founder Luis Von Ahn created a $700 billion valuation company. But the founder has an interesting portfolio of wins to his credit. From the groundbreaking reCAPTCHA security to the ESP game, all proved his “entrepreneurial genius.”

Your team’s expertise in education could be a deal-breaker. Are any of your team members educators, technologists, or learners?

User traction, engagement, and testimonials are crucial determinants.

7. Financial Stability

You might get a solid product vision and a massive user base, but investors also desire financial stability. Financial stability is related to risk, expected return, and your edtech potential to grow.

So, what do investors exactly look for in financial statements?

Investors look for the following aspects to assure financial stability:

- Revenue growth

- Profit margins

- Cash flow

- Operating Expenses

- Debt Level

Investors are keen to invest in startups that generate revenue. This indicates your product is gaining traction. Moreover, healthy profit margins indicate your pricing strategies and costs are well in control.

Besides, entrepreneurs look for investors who efficiently use the funding. So, investors are looking for startups that have mastered budgeting and forecasting. Besides, you must also know how to make those trade-offs.

8. Strong Product & Tech Vision

A strong vision is like a North Star guiding your edtech business towards success. It means you have a clear understanding of your software.

A product vision gives your team members a shared goal and direction. While creating your product vision, it’s important to take decisions from all the stakeholders.

Further, it sets the tone for your entire product. This includes everything from design to marketing!

Include immersive technologies like AI, VR, and gamification for driving innovation. Make sure your product offers realistic solutions to your audience.

Wrapping Up

Securing funding from investors is definitely challenging! You need an effective blend of innovation, strategy, storytelling, and financial planning. We have discussed some actionable insights through the blog to attract investors.

The edtech business is fiercely competitive with new startups entering the market. Hence, a well-prepared pitch isn’t enough! You need to demonstrate your scalability roadmap if you’re ready to build a robust edtech business.

FAQ-Related to What Investors Look for in Early-Stage EdTech Startups

1. Which funding option is perfect for early-stage startups?

Ideally, funding for early-stage startups depends on business needs, industry, and goals.

The following are the key funding options for early startups:

- Angel Investors (high-net-worth investors)

- Seed Funding

- Bootstrapping (self-funding)

- Crowdfunding

2. What do investors look for in early-stage startups?

Investors often look beyond an excellent business idea when funding.

These are the key points investors look for in early-stage startups:

- Problem-Solution Fit

- Unique Business Proposition

- Business Model

- Growth Opportunities

- Founder & Team Expertise

- Financial Stability

- Strong product & tech vision

3. What business models appeal to edtech investors?

Edtech investors often look for effective business models, including:

- Freemium-to-premium

- B2B

- B2C

- Enterprise Partnerships

4. How do investors assess impact in edtech?

A mere profit-loss sheet doesn’t determine your edtech solution’s impact. Founders need to look beyond qualitative and quantitative factors.

Here are the key aspects investors look for when determining impact:

- User engagement metric

- Learning outcomes

- Accessibility of underserved segments

- Evident behaviour change and skill mastery